European Sustainability Reporting Standards: What are they and what is new?

*New development since initial publication of this article: On March 29, 2023, EFRAG announced that the development of sector-specific ESRS will be delayed. This development follows the EU commissioner for financial services, financial stability and capital markets union’s call for EFRAG to prioritize helping companies implement the first set of ESRS standards https://www.efrag.org/News/Public-416/European-Commission-calls-on-EFRAG-to-prioritise-implementation-suppor

In January 2023, the EU’s Directive on Corporate Sustainability Reporting (CSRD) entered into force. The CSRD requires companies in the EU (and some outside the EU) to disclose information on their social and environmental impacts. The CSRD’s requirements are phased in, becoming applicable to certain companies in their 2024 fiscal year with the first report expected in 2025.

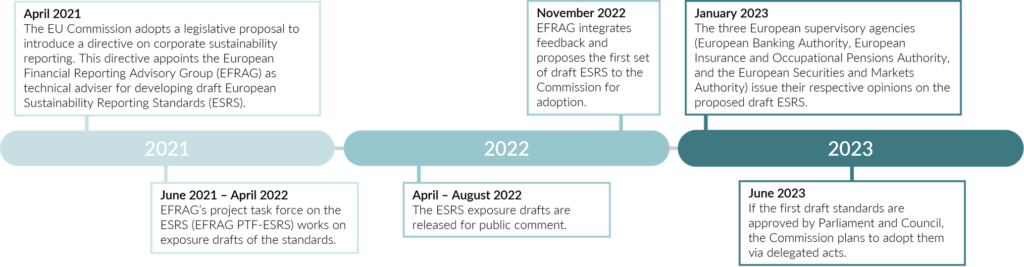

One of the key provisions of the CSRD is that companies’ reporting must comply with the European Sustainability Reporting Standards (ESRS) created by the European Financial Reporting Advisory Group (EFRAG).[1] The ambitious ESRS will help ensure a level playing field, and they are essential to delivering comparable data. EFRAG has been working on sustainability reporting standards since 2021, and the EU Commission is expected to adopt the first set as delegated acts in June 2023.[2] More sector-specific standards will be progressively adopted in the upcoming months and years.

Figure 1. The European Financial Reporting Advisory Group (EFRAG) has been working on sustainability reporting standards since 2021. The EU Commission aims to finalize the first set in mid-2023.

What are the first set of European Sustainability Reporting Standards?

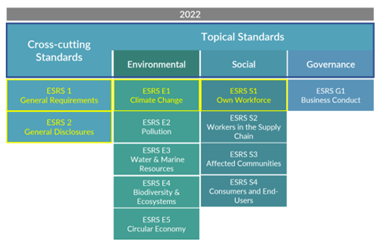

The first set of draft ESRS are 12 standards of detailed expectations for corporate reporting on environmental, social, and governance (ESG) matters: two general, five environmental, four social, and one governance reporting standard. Additional sector-specific (industry-focused) standards will be published later in 2023. Figure 2 provides a high-level overview of how the ESRS are structured.

Figure 2. The ESRS are structured according to sector-agnostic and topical standards. The yellow highlight indicates which standards are required despite the outcome of an entity’s materiality assessment.

A materiality assessment is the starting point

A core concept of the ESRS is materiality, namely that materiality of a sustainability issue should guide companies as they define reporting areas relevant to their operations. The ESRS are based on a double-materiality approach that involves analyzing: 1) the impact of ESG risks on the company, and 2) the impact of the company on society and the environment. The yellow highlight in Figure 2 indicates which standards must be followed despite the outcome of an entity’s materiality assessment, the others depend on the result of a materiality assessment.

In the draft ESRS 1 General Requirements submitted to the EU Commission, EFRAG clearly states that companies must embrace double materiality when reporting on sustainability matters. According to EFRAG, double materiality has two dimensions:

- Impact materiality: disclose the impact of ESG risks on the company and the impact of the company on society and the environment; and

- Financial materiality: disclose only what impacts the company, with the primary objective of informing investors about financial risk to their investment.

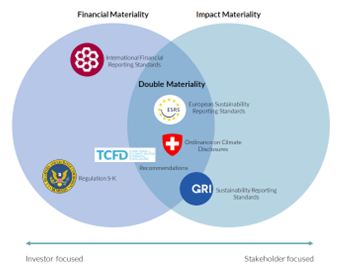

Double materiality is the intersection of impact- and financial-materiality approaches. In this approach, analysis of a company’s impacts includes its impact on people and the environment, incorporating information relevant to a wide variety of stakeholders, as well as the impact of sustainability risks on the company. Figure 2 shows how several other reporting standards have addressed materiality.

Figure 3. Comparing the materiality approaches of selected sustainability-related reporting standards.

Steps were taken to align the draft ESRS with impact materiality assessment promoted by the Global Reporting Initiative, which oversees the predominant standard guiding corporate sustainability-related disclosure in the EU. EFRAG also took steps to closely align its standards with the proposed International Sustainability Standards Board sustainability reporting standards, which will likely become the global baseline for reporting.

How have the first set of ESRS been received?

The European supervisory authorities (ESAs), consisting of the European Banking Authority, the European Insurance and Occupational Pensions Authority and the European Securities and Markets Authority, have provided their feedback on the first set of cross-cutting and topic standards. Overall, the ESAs provided positive feedback and highlighted common requests, such as the need to clarify the boundaries of value-chain reporting so the specific nature of financial institutions is reflected. They also indicated a need for further guidance on materiality assessment and automatic cross-compliance with the ISSB’s standards.

The European Central Bank (ECB) also published an opinion on the ESRS in January. The ECB thinks the standards will improve the quality of corporate sustainability disclosures, making them more comparable. The opinion includes several suggestions for revisions, including a clearer definition of the term “value chain” as it relates to financial institutions.

What is EFRAG working on now?

EFRAG continues to work on the second set of ESRS dealing with sector-specific standards, which must be adopted by the end of June 2024. It is expected that a 100-day consultation, beginning in April 2023, will be held to discuss: 1) the ESRS sector-classification system, 2) coal-and-mining sector reporting standards, and 3) oil-and-gas (upstream and downstream) sector reporting standards.

Shortly after, in May 2023, EFRAG expects to hold 90-day consultations on: 1) the mandatory standards for listed small and medium-sized enterprises (SMEs) as well as a voluntary SME standard (one of the recommendations of a group of German SMEs that piloted the voluntary SME ESRS was to standardize disclosure requirements for all SMEs), and 2) agriculture, farming, and fishing reporting standards, and 3) a road transport reporting standard.

What’s next?

- First set of ESRS: The Commission is now analyzing feedback received on the first set of ESRS from member states and EU bodies in addition to the opinions from the ESAs and ECB. The Commission will likely revise the standards based on this feedback and then open a new version for comment in April. Once finalized, the first set of cross-cutting and topical ESRS will be adopted via a delegated act by the end of June 2023.

- Sector-specific ESRS: A second set of ESRS must be finalized by EFRAG and handed over to the Commission in November 2023. Following scrutiny by the Commission and a consultation, these standards must be adopted in June 2024.

- ESRS for financial institutions: Over the course of 2024, with the goal of being enacted in June 2025 and effective as of 2026, ESRS specifically for financial institutions will be developed by a dedicated working group. This group will also prepare guidance on value-chain reporting to complement the first set of ESRS.

[1] EFRAG is a private association created in 2001 to serve the public interest. In 2022, EFRAG was appointed technical adviser to the EU Commission and given the mandate to develop draft ESRS.

[2] In March 2023, EFRAG created a set of educational videos to help interested stakeholders better understand the draft standards.

All posts

All posts Contact

Contact