Biodiversity-related risk moves up the ESG agenda

Photo by Joel Holland on Unsplash

Photo by Joel Holland on UnsplashIn December 2022, governments will convene at the 15th Convention on Biological Diversity (CBD) Conference of the Parties in Montreal, Canada, to agree on new goals to protect and restore nature — the Post-2020 Global Biodiversity Framework. A landmark 2019 report by the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) showed a massive erosion of the world’s ecosystems, and the discussions about the Post-2020 Framework suggest biodiversity is moving up the ESG agenda. It is now “the fastest developing ESG theme in global capital markets,” closely shadowing the route climate change has taken.

Biodiversity is decreasing rapidly

Biological diversity is decreasing at a speed not seen since the last mass extinction 65 million years ago. According to IPBES, human activity has severely altered 75 percent of the world’s land surface, 66 percent of the ocean area, and led to the loss of over 85 percent of wetland areas. As a result, around 25 percent of animal and plant species are threatened, with one million species facing extinction – many of them within decades. The five primary drivers of nature loss are climate change, the introduction of invasive species, land use change, the overexploitation of natural resources, and pollution of air, land, and water.

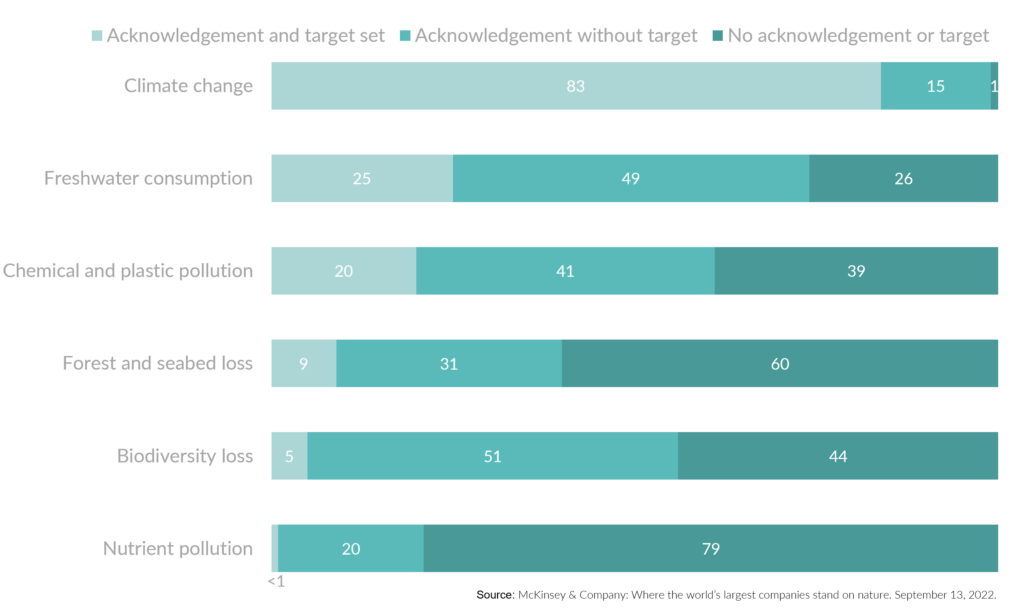

Companies traditionally only acknowledge risks related to climate

Over half of global gross domestic product depends on nature and its services, and the World Economic Forum now considers biodiversity loss the third most severe risk on a global scale. While companies increasingly commit to nature-related goals, these are mostly framed in relation to climate change; significantly fewer goals address biodiversity and other nature-related dimensions (Figure 1).

Loss of nature carries physical, transition, and liability risks

As climate change and degradation of nature are deeply intertwined, companies focusing solely on climate while neglecting biodiversity loss and other nature-related issues will miss numerous risks and opportunities. Biodiversity risk can be categorized into physical, transition, and liability risks — all ultimately result in financial risk (Figure 2).

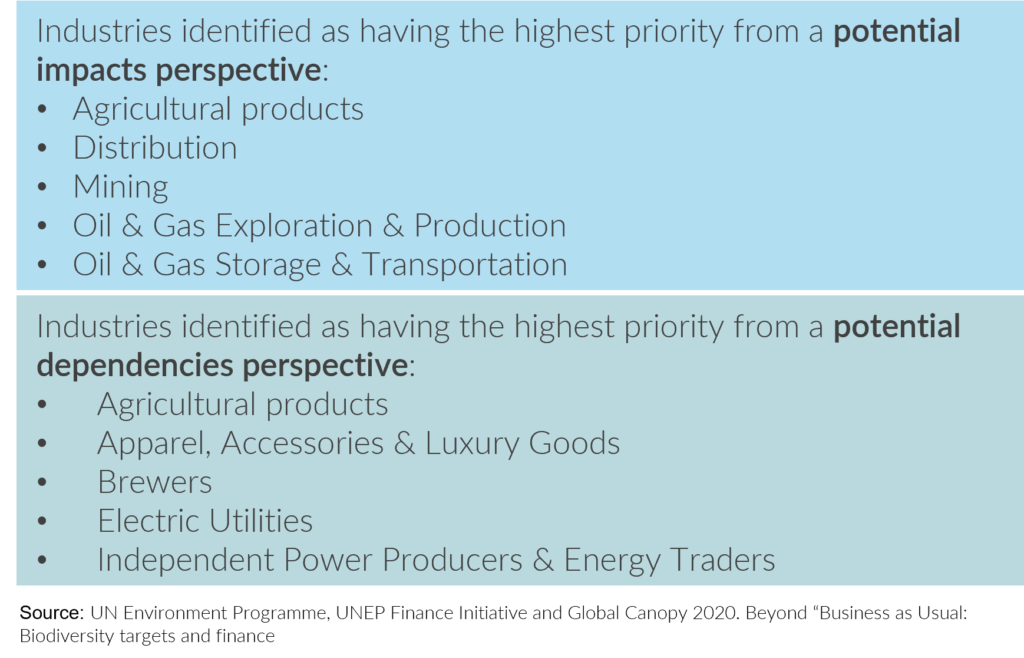

Multisectoral impacts and dependencies

These risks emphasize biodiversity loss is a major global systemic risk. Not only are industries such as forestry or agriculture affected, many other sectors that impact or depend on nature are as well (Figure 3).

The Network for Greening the Financial System, a group of 114 central banks and financial supervisors, is of the view that nature-related risks can have severe macroeconomic implications. A statement from the group acknowledges that biodiversity loss poses significant risks for financial institutions and for financial stability.

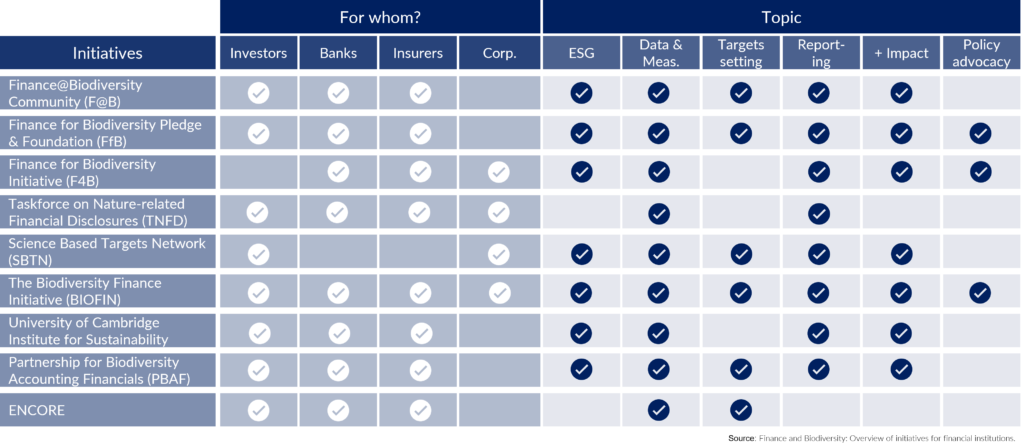

Emerging biodiversity-finance initiatives

It is thus not surprising that financial institutions are beginning to recognize risks associated with biodiversity loss. Several biodiversity-related initiatives involving the financial industry focus on knowledge sharing, generating best practices, and exploring the opportunities and challenges of assessing and disclosing these risks (Figure 4).

The Taskforce for Nature-related Financial Disclosures (TNFD) is among the most prominent initiatives. Twelve out of the nineteen financial institutions reviewed in ECOFACT’s Monitoring Peer Policies mention the work of the TNFD in their environmental and social risk policies or frameworks. The TNFD is developing a global framework to measure and publicly report the financial risks created by the degradation of nature, biodiversity, and habitats. In July 2022, the TNFD published the second iteration of its draft Nature-Related Risk and Opportunity Management and Disclosure Framework to inform consultation with market participants. The TNFD aims to finalize the framework by the end of 2023.

Biodiversity will require a double-materiality approach, like climate change

While the TNFD considers nature-related risks as “potential threats posed to an organization linked to its and other organizations’ dependencies on nature and nature impacts,” financial institutions’ biodiversity policies or statements currently focus on the risks to biodiversity: eleven of the financial institutions in the peer set analyzed in ECOFACT’s Monitoring Peer Policies describe risks to biodiversity, for example deforestation. Only two explicitly recognize the impact biodiversity loss may have on their clients (mainly in agriculture and pharmaceutical sectors).

However, as the work of the TNFD and other biodiversity-related initiatives advances, financial institutions will be expected to strengthen their approach to meet requirements that will likely take a similar trajectory to those for climate change.

At ECOFACT, we closely monitor ESG developments. We can help you understand biodiversity-related risks and regulation, and we can help you align with stakeholder expectations by adjusting your company’s approach to biodiversity. If you would like further information, do not hesitate to reach out.

All posts

All posts Contact

Contact