Understanding Adverse Impact

Financial institutions are now expected to address any adverse impact resulting from their business and investment decisions. This requires a new, fundamentally different perspective on risk.

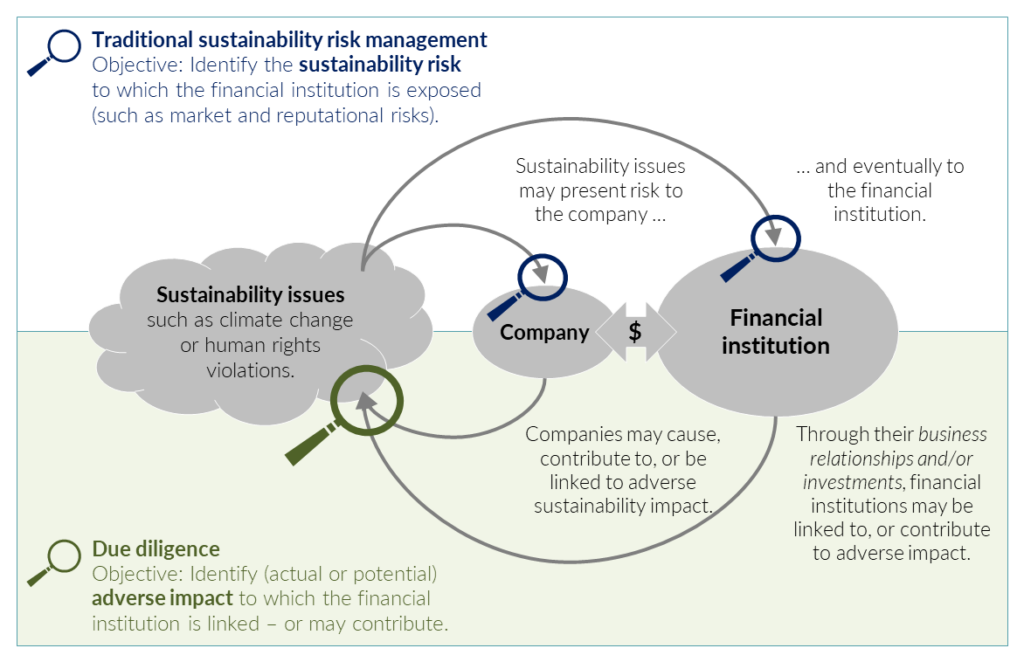

Having talked to clients and students, we find that this is best explained by the chart shown below. We originally drafted this for the OECD when we were helping them to adapt their due diligence guidance for the financial sector.[1] We have continuously revised it ever since, most recently in order to take into account the wording used in EU regulations. The chart explains how the concepts of sustainability risk and adverse impact are based on differing perceptions of risk (indicated by the magnifying glasses). While traditional sustainability risk management aims to mitigate risk for financial institutions and their clients, environmental and human rights due diligence focuses on mitigating the risks that result for “others” – both people and the natural environment affected by adverse impact. In the words of the OECD, addressing adverse impact requires financial institutions to adopt an outward-facing approach.[2]

The concept of adverse impact has now entered the central arena – initially through soft law guidance[3] and more recently through hard law.[4] There is, of course, a link between sustainability risk and adverse impact: investing in a coal-fired power plant will pose a sustainability risk because it may involve substantial adverse impact. Unfortunately, however, adverse impact is usually caused by activities that carry no consequences. While these activities may be the root cause of sustainability challenges, they do not present an actual sustainability risk – or only in the long term. If the financial sector wants to help to address sustainability challenges, merely mitigating sustainability risk will inevitably be insufficient. Potential adverse impact must therefore also be understood and managed.

All posts

All posts Contact

Contact