News from ECOFACT Q1 22

These are truly challenging times. However, we see evidence of positive change such as the European Union’s encouraging efforts to achieve a sustainable and low-carbon economy. In the first quarter of 2022, market regulators stepped up their fight against greenwashing, and the European Commission proposed a new directive on corporate due diligence. These are just two examples demonstrating the rapid evolution of the EU legal landscape — market participants need to make great efforts to keep up.

Are you ready to report on ESG risks under the amended EU CRR?

In June 2022, the EU’s amended Capital Requirements Regulation (CRR) will enter into force. Large, listed banks must disclose prudential information on environmental, social, and governance (ESG) risks. In January 2022, and as part of the CRR, the European Banking Authority published implementing technical standards (ITS) on Pillar 3 disclosures on ESG risks. The ITS aim to make financial institutions’ ESG disclosures comparable.

The new requirements will reveal how these institutions are embedding ESG considerations in their risk management, business models, and strategies. Ultimately, the goal of the amendments is to ensure that stakeholders are well-informed about financial institutions’ exposure to ESG risks and understand how these risks are being mitigated. The ITS require disclosure on the tools used to identify and monitor ESG risks as well as disclosure on how ESG risks and processes are integrated into governance, strategies, and risk management.

ECOFACT’s extensive regulatory implementation and ESG risk management services mean we are well-equipped to support your compliance with the new CRR disclosure requirements.

On our radar: The TCFD’s growing influence

March was an exciting month for climate reporting:

- The Swiss Federal Council opened a consultation on a proposed ordinance that would require large companies to institute climate reporting in line with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD).

- The US Securities and Exchange Commission (SEC) published proposed rule amendments that would require US-listed companies to disclose climate-related risks in their registration statements and periodic reports.

- The International Sustainability Standards Board (ISSB) published two draft documents for public consultation: Exposure Draft IFRS S1 – General Requirements for Disclosure of Sustainability-related Financial Information and Exposure Draft IFRS S2 – Climate-related Disclosures.

These proposals all build on the TCFD reporting framework. The TCFD’s recommendations appear to be emerging as the essential blueprint for climate disclosure. ECOFACT is actively advising firms on implementing the TCFD recommendations and developing climate strategies.

We’re tracking the evolution of corporate due diligence

On February 23, 2022, the EU Commission published the long-awaited proposed Directive on Corporate Sustainability Due Diligence (CSDD Directive). This directive would require companies to conduct environmental and human rights due diligence on their own activities, on their subsidiaries’ activities, and on the value chain operations carried out by companies they have established business relationships with.

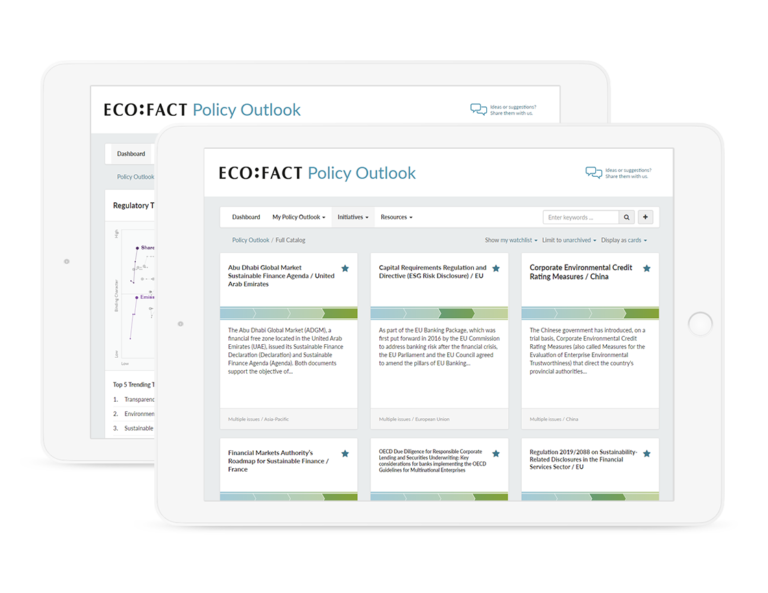

It will standardize and harmonize due diligence obligations throughout the EU. We also expect the CSDD Directive to trigger even more growth in this area in the EU and abroad as other jurisdictions keep pace. Our Policy Outlook tool tracks regulatory developments related to sustainability, not just in Europe but also around the world; it reveals an expansion of due diligence obligations everywhere.

Do your ESR policies address biodiversity issues?

Some institutions’ environmental and social risk (ESR) policies do! The topic is gaining traction because the services of nature are being recognized as critical to the economy. An upcoming Monitoring Peer Policies call will report on the biodiversity policies of 19 financial institutions. We will also discuss the outcome of the Conference of the Parties to the Convention on Biological Diversity (COP15) meeting. Delegates from 190 countries aim to finalize a global plan to stop biodiversity loss and steer financial flows toward biodiversity conservation and restoration.

All posts

All posts Contact

Contact