Green Bonds: An Overview of the Current Frameworks

Green bonds are instruments enabling capital-raising and investment for new and existing projects with environmental benefits. These bonds have gained considerable prominence as a way for the private sector to contribute to the low-carbon economy transition.

The green bond market emerged with first issuances by multilateral development banks raising funding for climate-related projects in 2007–2008. Until 2012, the main issuers of green bonds were sovereign supranational agency actors such as the World Bank, the International Finance Corporation, and European investment banks. The increase of both the demand and the supply of capital for green projects led to rapid growth of the green bond market, with USD 37 billion in green bonds being issued in 2014. This growing appetite for green bonds led to a diversification of investors and issuers. Supported by the International Capital Market Association’s (ICMA) 2014 launch of the Green Bond Principles (GBP), private issuers, such as companies and banks as well as countries, have increasingly acted as issuers of green bonds. For example, in 2019, China was the world’s largest source of labelled green bonds.

As the market evolves, it faces several challenges, especially regarding transparency, reporting, and a need for harmonization. The capital markets are seeking greater clarity on how green projects may contribute to environmental objectives, as well as their alignment with other green taxonomies, classifications, and related environmental standards. Establishing common green bond project definitions and requirements for disclosure of the use of proceeds is the basis for developing a credible green bond market that avoids “green washing”.

Presently, there is no uniform legal definition of what is considered “green” which could be applied to all asset and sector categories. The lack of consensus on whether a bond qualifies as green or not, and the need for transparency and reporting, led to harmonization efforts over the last decade. The ICMA and the Climate Bond Initiative (CBI) have developed principles and standards to help determine whether a bond qualifies as green or not.

Two categories of green bonds have emerged, green labeled bonds (certified as green) and unlabeled green bonds (issuances linked to projects that produce environmental benefits). Climate bonds are a sub-category where the proceeds are linked to projects that address climate change. In the absence of globally accepted specific guidance on what is a green project, the majority of issuers commission independent reviews of their green bond investment frameworks.

The two most widely accepted sets of principles and standards are ICMA’s GBP and CBI’s Climate Bonds Standard (CBS). Building on these criteria, issuers, underwriters, and investors have developed their own frameworks, the leading rating agencies now rate green bonds, and several regional and national governments have started to issue guidance.

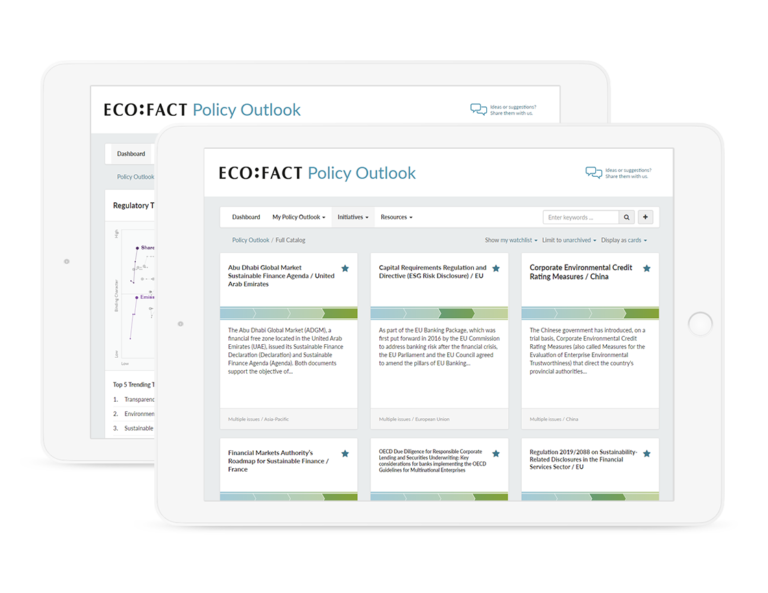

You can access the full version of this article by subscribing to Policy Outlook. If you have any specific questions regarding green bond regulatory frameworks, do not hesitate to reach out to us.

All posts

All posts Contact

Contact