Fiduciary Duty & ESG Issues: How Are Different Jurisdictions Addressing This?

One of the main hurdles preventing the widespread inclusion of material environmental, social, and governance (ESG) and long-term sustainability factors in investment decisions is the lack of clear legal guidance on whether this is allowed by fiduciary duty.

Fiduciary duty, as it applies to investment and investment advisory relations, is defined as a set of cardinal rules with roots in common law jurisdictions, such as the USA and UK, and often encompasses a duty of loyalty and a duty of care. Similar concepts also developed in civil law jurisdictions, such as in France and Brazil.

Lately, several legal initiatives around the globe have sought to remedy the incongruity between ESG and long-term sustainability factors and institutional investors and asset managers’ fiduciary duties. For example:

- Canadian Expert Panel on Sustainable Finance: In its interim report the Panel stated that a clear interpretation of fiduciary and legal duties is essential for financial services professionals who invest for and advise others;

- EU Regulation on Disclosures Relating to Sustainable Investments and Sustainability Risks and Amending Directive 2016/2341: The regulation is expected to help mainstream the integration of ESG considerations into investment and advisory processes and boost the recognition of ESG factors as value drivers;

- Implementation of IORP II by EU member states: According to article 19 of IORP II, institutions for occupational retirement provision will be allowed to consider the impact of ESG factors on their investments;

- UK financial regulators: The Financial Conduct Authority and the Prudential Regulation Authority are currently working on regulatory guidance for financial institutions and institutional investors that will support the transition to a low-carbon economy and address climate-related risks; and

- US House of Representatives: The House Committee on Financial Services will be convening a hearing to examine proposals to improve ESG disclosures in the USA.

Courts also play an important role in framing the obligations arising from fiduciary duty. Trends in litigation against pension funds related to their approach to climate-related risks, and brought forward by beneficiaries, should not be ignored.

As an example, in the case of McVeigh v. Retail Employees Superannuation Trust (REST), the plaintiff seeks a decision from the Australian court that would establish that his pension fund has breached fiduciary duty owed to him by failing to adequately consider climate change risks. The court ordered Mr. McVeigh to make another application that would formally cap the legal costs he could incur in the proceeding. REST was required to file a concise statement responding to the plaintiff’s allegations. The next hearing is scheduled for April 2, 2019, at the Federal Court in Sydney.

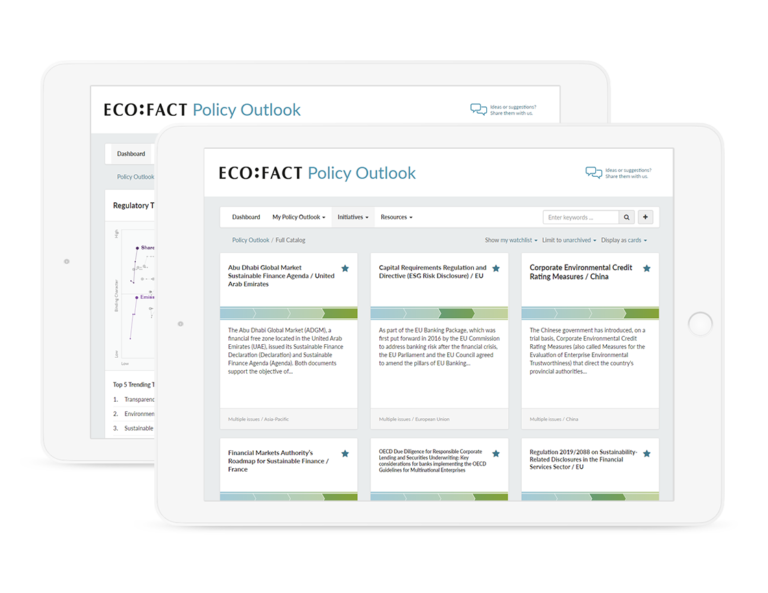

For a complete and comprehensive overview of fiduciary duty laws and regulations applicable to the financial sector, please check the ECOFACT Policy Outlook Tool. There you will also find similar briefings on different trending regulatory topics. These briefings are updated every month and available in different formats.

All posts

All posts Contact

Contact