EU Social Taxonomy: A Tour of the PSF’s Final Report

Russia’s invasion of Ukraine has brought the world’ attention to social issues such as human rights. Amid this humanitarian crisis, the Platform on Sustainable Finance (PSF) published a highly anticipated report on the proposed EU social taxonomy.

This report advises the EU Commission on which social issues and objectives should be part of the Taxonomy Regulation, the criteria that should qualify economic activities as “socially sustainable,” and how the taxonomy’s social objectives should be defined and measured.

Here, we highlight key information revealed in the report. For more detailed information, Policy Outlook users can access an in-depth analysis of the PSF social taxonomy report in our tool.

Overall goals

The proposed social taxonomy aims to nudge the market toward realizing the following global and regional aspirations:

- achieving the Sustainable Development Goals (SDGs) of the UN’s 2030 Agenda; and

- creating the social market economy envisaged in article 3(3) of the Treaty on European Union.

Moreover, a social taxonomy will offer businesses the opportunity to apply the UN Guiding Principles on Business and Human Rights (UNGPs) even further.

Support the market

Understandably, regulating a social taxonomy may raise concerns — it signals more rules are on the horizon and more compliance work will be required of financial institutions and corporations. Still, the PSF’s recommendations attempt to reflect the growing market demand for a tool that promotes social goals, just like the environmental taxonomy promotes climate and environmental goals.

When drafting the report, the PSF considered:

- investment opportunities related to social issues, such as leveraging existing social bonds and social-impact bonds to finance healthcare and affordable housing;

- how the taxonomy could help companies and investors manage the reputational and financial risks associated with the social impact of their economic decisions; and

- the need to clarify what constitutes a socially sustainable investment to level the market’s playing field.

Social and environmental: same but different

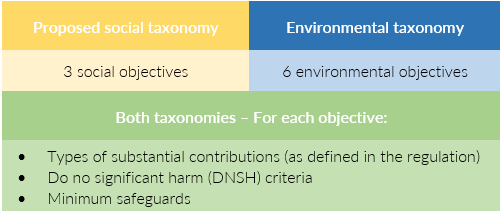

During a public consultation on the draft version of the PSF’s report, market participants asked for the proposed social taxonomy to follow the same structure as the environmental taxonomy. The table below shows how this structure has been applied to both taxonomies:

In the future, this parallel structure may support asset managers and banks that wish to combine investments with social and environmental objectives in one financial product.

Social objectives and sub-objectives

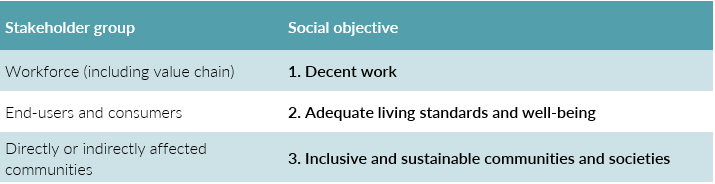

The PSF endorses a stakeholder-centric approach to social issues, much like the European Financial Reporting Advisory Group (EFRAG) does. Hence, the proposed social taxonomy prioritizes three stakeholder groups and sets one objective per group:

For each proposed social objective, there are long, non-exhaustive lists of sub-objectives. Here are a few examples:

- Decent work: promoting decent work, promoting equality and non-discrimination at work, and ensuring respect for human rights and workers’ rights of affected workers in the value chain.

- Adequate living standards and well-being of end-users: healthy and safe products and services, durable and repairable products, and responsible marketing practices.

- Inclusive and sustainable communities and societies: promoting equality and inclusive growth, supporting sustainable livelihoods and land rights, and ensuring respect for the human rights of affected communities by carrying out risk-based due diligence.

This means it is possible for an economic activity to substantially contribute to several objectives and sub-objectives simultaneously.

Substantial contributions

Three types of substantial contributions are proposed:

- Avoiding and addressing negative impact;

- Enhancing the inherent positive impacts of social goods and services and basic economic infrastructure; and

- Enabling activities.

Do no significant harm

According to the PSF report, the DNSH criteria should serve the social taxonomy in the same way they serve the environmental taxonomy. Hence, to be taxonomy-eligible, an economic activity that makes a substantial contribution to one social objective should not significantly harm the other social objectives. This principle applies equally to sub-objectives.

Minimum safeguards

Article 18 of the Taxonomy Regulation requires all economic activities to respect minimum safeguards. This means complying with key international standards on fundamental human rights, workers’ rights, and principles of good governance (like anti-bribery measures or non-aggressive tax planning). This article currently lacks enough detail to be fully implemented, and the PSF is working to clarify what it means. It is expected to issue a report on this topic in 2022. The proposed social taxonomy would also be subject to minimum safeguards as well.

Neither far away nor close

The PSF report is a constructive step toward extending the Taxonomy Regulation to social issues. However, there are several steps to take before this can become a reality.

Article 26(2)(b) of the Taxonomy Regulation requires the EU Commission to publish a report by December 2021 that describes the provisions needed to cover social objectives. As of March 2022, this had not been issued (given that the PSF’s late input), the EU Commission is now expected to issue its own report during 2022.

While the PFS’s recommendations are not binding, the EU Commission has often applied the group’s advice to legislative proposals. Note: One notable departure from this tendency was the EU Commission’s recent adoption of the Complementary Climate Delegated Act; it decided to forgo the PSF’s recommendations on the inclusion of nuclear energy and natural gas.

All posts

All posts Contact

Contact